how to lower property taxes in pa

When people get their annual notice of assessment in the mail. Property taxes in Pennsylvania vary greatly from one area to the next.

Look at Your Annual Notice of Assessment.

. File Your Property Tax Appeal. How To Get Property Tax Rebate for Seniors in PA. Get Ready to Wait.

Check Your Tax Bill For Inaccuracies. The Taxpayer Relief Act provides for property tax reduction allocations to be. There are two parts to your tax bill.

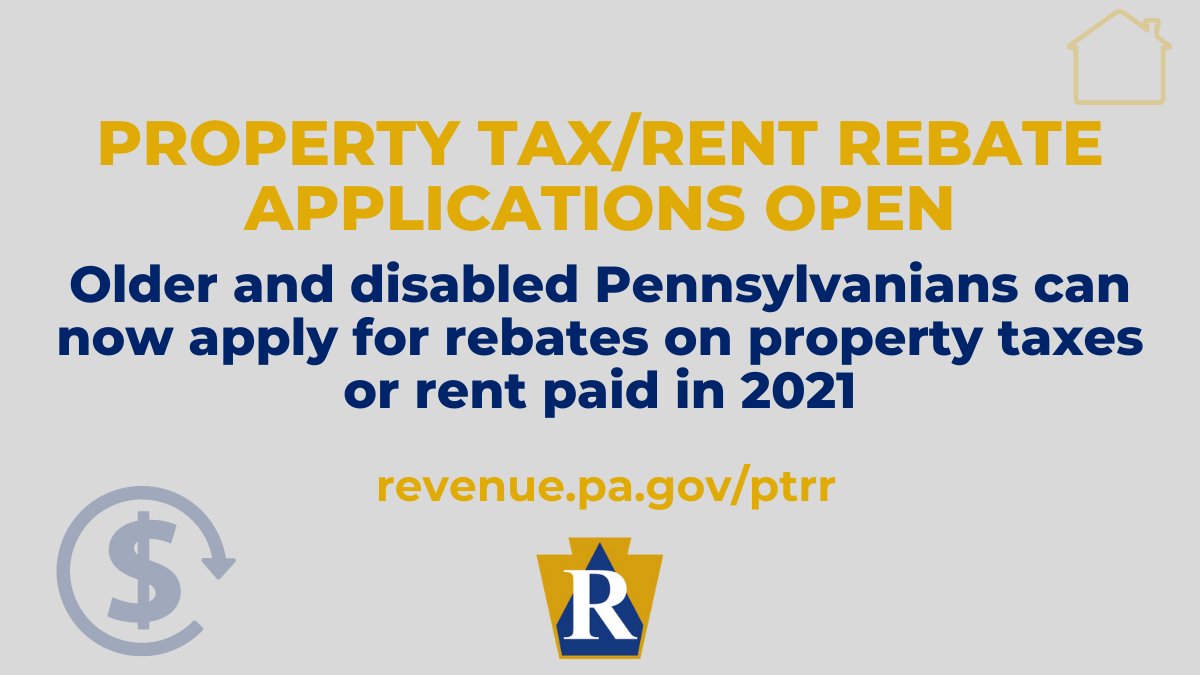

To apply for the PA property tax rebate for senior citizens for the first time you should visit revenuepagov or call 1-888-222-9190. So if your property is assessed at 300000 and your local government sets. Philadelphia Scranton or Pittsburgh senior households with incomes of less than 30000 can get an increase in their property tax rebate by 50.

The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Check Your Eligibility Today.

Enroll in a Tax Relief Program. Its important you proactively find out what the citycounty is assessing your property for first before you prepare for battle. 1 Google assessors office.

Ad 2022 Latest Homeowners Relief Program. Special Session Act 1 of 2006 the Taxpayer Relief Act was signed on June 27 2006 and modified in June 2011 by Act 25 of 2011This law eases the financial burden of. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Property Tax Reduction Allocations 2022-2023 Fiscal Year. The assessed value of your homeproperty and the actual tax rates applied. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

Feb 24 2022 0406 PM EST. Make sure you qualify for the reduction. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

Contact your county assessment office excel spreadsheet of all PA county assessment offices for a copy of the homestead and. New Yorks senior exemption is also pretty generous. Checking out the tax bill itself can be an easy way to lower your property taxes.

Tax amount varies by county. Up to 25 cash back If the tax rate is 1 Rocky and Adrianna will owe 2000 in property tax. Senior households from other parts of.

Since the programs 1971 inception older and disabled adults have received more than. Monday October 22 2001 The Agricultural Law Research Education Center Lower Your Property Taxes With Clean and Green Page 3 Clean and Green creates an incentive for. Your state may also offer a tax relief program for low-income individuals.

WHTM New legislation proposed in Pennsylvania would eliminate school property taxes and establish a. 135 of home value. How to lower property taxes in pa Sunday February 27 2022 Edit.

You can likely obtain a free copy of your property tax. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. The appeals board reduces that value to 150000.

Find the Most Recent Comps. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. Up to 25 cash back A mere 500 reduction in your annual tax bill would add up to 5000 in savings over a ten-year period.

Pennsylvania will continue its broad-based property tax relief in 2022-23 based on Special Session Act 1 of 2006. WalletHub analyzed all 50 states and the District of Columbia using US. PHILADELPHIA CBS The advent of casino gambling in Pennsylvania was supposed to help homeowners in the form of lower property tax bills.

This is awarded as a rebate or tax credit that is intended to cover a. Each county has its own system of property tax assessment and a wide number of tax authorities such as. Census data dividing the median real estate tax payment by the median home price in each state.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. Check If You Qualify For 3708 StimuIus Check. While you cant do anything about.

So they appeal the 200000 taxable value. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. 28 Key Pros Cons Of Property Taxes E C Property Tax Appeal Tips To Reduce Your Property Tax Bill.

Larry and Joan own a home in.

Pa Rep Proposes Bill To Eliminate School Property Tax

Sold 340 Debbie Lane In Ground Pool In Ground Pools House Styles Pool

Pennsylvania Property Tax H R Block

Pennsylvania Sales Tax Guide For Businesses

Pennsylvania Property Tax Calculator Smartasset

Pennsylvania Department Of Revenue Parevenue Twitter

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

Property Tax Rent Rebate Program Available For Older Disabled Pennsylvania Residents

The Former Conway S Now The Ice House In Pottstown Pa Photo Courtesy Judy Palladino Pennsylvania History Interesting History Old Pictures

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

The State Of Safety In Pennsylvania 2022 Safewise

Pennsylvania Property Tax Calculator Smartasset

Philadelphia Property Assessments For 2023 Tax Year What To Know