pay utah state sales tax online

Counties and cities can charge an additional local sales tax of up to 24 for a maximum. Questions about your property tax bill and payments are handled by your local county officials.

Sales Use Tax Info Millard County

Local tax rates can include a local option up to 1.

. Local jurisdictions also have a sales and use tax rate. Some examples of items that are exempt from Utah sales. Do not staple your check to your return.

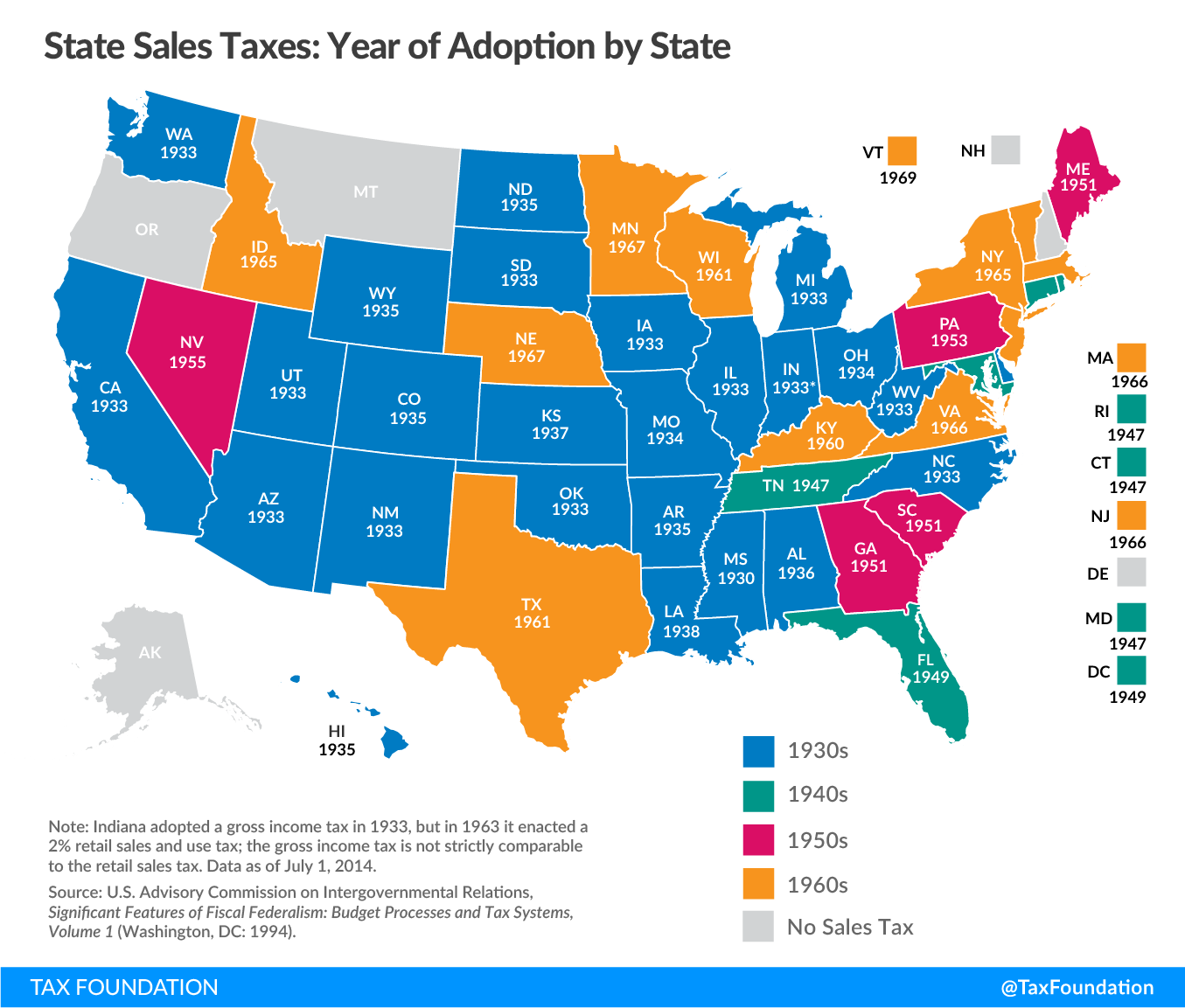

Modern retail sales tax is generally considered to date back to 1930 and is managed at a state level. Write your daytime phone number and 2021 TC-40 on your check. The state sales tax rate in Utah is 4850.

With local taxes the total sales tax rate is between 6100 and 9050. Additionally the state has excise and special taxes for. Sales tax requires merchants pay sales tax of some kind in states.

If you are mailing a check or money order please write in your account number and filing period or use a. Utah has recent rate changes Thu Jul 01 2021. Utahs sales tax rate is 485 percent of retail goods and some services sold.

Remove any check stub before sending. Please contact us at 801-297-2200 or taxmasterutahgov for more information. You can also pay online and.

Sales Related Tax and Schedule Information. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Filing Paying Your Taxes. Utah is an origin-based sales tax state. The total tax rate might be as high as 87 depending on local jurisdictions.

How To Pay Utah State Taxes Online. Please visit this page to contact your county officials. That rate could include a combination of.

Do not mail cash with your return. In the state of Utah sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The state sales tax in Utah UT is 47 percent.

This blog gives instructions on how to file and pay sales tax in Utah using the TC-62M Sales Use Tax Return a return used by out-of-state sellers. This means you should be charging Utah customers the sales tax rate for where your business is located. You can also pay online and.

Monthly quarterly and annual sales tax returns.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Why Some States Are Dealing With A Tax Revenue Surplus Marketplace

Utah Sales Tax Calculator And Local Rates 2021 Wise

Utah Sales Tax Proposal Should Avoid Layering Taxes On Business Inputs

Online Sales Tax Fight Set To Resume In Utah Capitol But This Year With A Wrinkle The Salt Lake Tribune

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Tc 62s Fill Out Sign Online Dochub

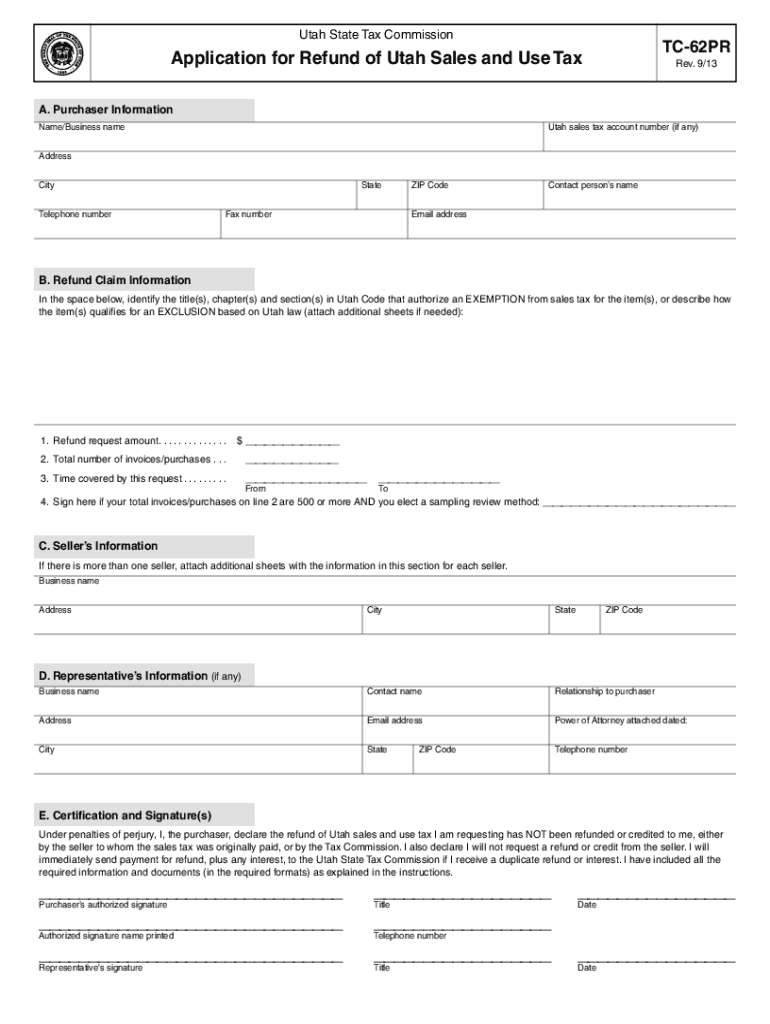

2013 2022 Form Ut Tc 62pr Fill Online Printable Fillable Blank Pdffiller

Buying Online To Avoid Sales Tax And Not Paying Use Tax Congress May End That Soon

State Of Utah Job Opportunities Sorted By Job Title Ascending Worklife Elevated

Grazing Rock Llc Utah Sales Tax License Grazing Rock

Utah Ruling Software And Sales Tax Avalara

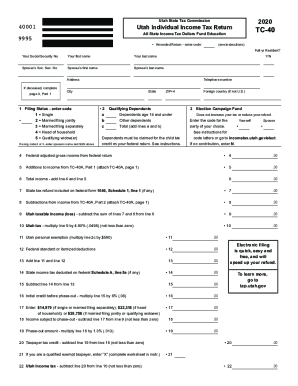

Utah State Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Utah Lawmakers Eye Online Purchase Sales Tax Say State Is Missing Out On Millions Kutv

Most States Now Tax Online Purchases

State And Local Sales Tax Rates Midyear 2022

How To Register For A Sales Tax Permit Taxjar

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities